Negotiable Instruments Act, 1881 notes with GK for Banking aspirants. If you are preparing for SBI PO, IBPS, SBI Clerkship examinations, then this article is suitable for you. Here the important sections of NI ACT 1881 are given with explanation.

Negotiable Instruments Act, 1881 for Banking Notes GK: On a daily basis, banks deal with Negotiable Instruments (Ni). “A document that can be transferred from one person to another by endorsement and delivery is referred to as negotiable.” In the event of a dispute between the parties, the term “instrument” refers to a legally enforceable document. Demand Promissory Notes, Bills of Exchange, and Cheques are some instruments available. Banks deal with demand drafts and other similar items in their day-to-day interactions with consumers. As a result, every banker should have a full awareness of some of the NI Act’s most significant clauses.

Important Section on Negotiable Instruments Act, 1881,

The following are some of the most essential sections.

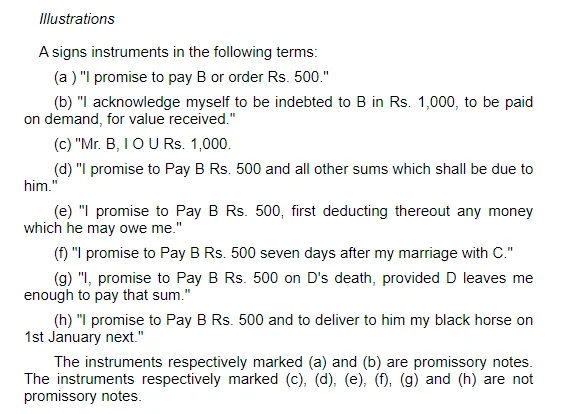

Section 4, A Promissory Note: A Promissory Note is defined as a written instrument holding an unconditional pledge, signed by the maker, to pay a certain sum of money only to, or on the order of, a specific person, or to the bearer of the instrument.

Section 5 Bill of Exchange: The characteristics of a Bill of Exchange are described in Section 5 of the NI Act. It is a written instrument carrying an unconditional order signed by the creator commanding a specific individual to pay a certain sum of money only to, or on the direction of, a specific person or the bearer of the instrument.

Section 6 of the NI Act (Cheque): The most commonly used instrument, the cheque, is defined as “a bill of exchange drawn on a particular banker and not expressed to be payable otherwise than on demand” under Section 6 of the NI Act.

Section 7 Drawer: The drawer is the person who creates a bill of exchange or a cheque, while the drawee is the one who is directed to pay.

In case of need, drawee: — When the name of any person is mentioned in addition to the drawee to be resorted to in case of necessity in the Bill or any endorsement thereon, that person is referred to as a “drawee in case of need.”

Acceptor: “Acceptor” once the drawee of a bill has signed his assent on the bill, or, if there are more than one portion of the bill, on one of the parts, and handed or given notice of such signature to the holder or to another person on his behalf.

Acceptor for honour: [When a bill of exchange has been noted or protested for non-acceptance or greater security,] and someone accepts it over protest for the drawer’s or one of the endorsers’ honour, that person is referred to as an “acceptor for honour.”

Payee: The “payee” is the person stated in the instrument to whom or on whose command the money is directed to be paid by the instrument.

A cheque should be drawn on a banker and contain the right date (not older than three months), name of the payee (person to whom it is payable), amounts in words and figures, the drawer’s signature (person who has issued the cheque), and be drawn on a banker (known as the drawee).

Section 10 Payment in due course: The right method of payment for an instrument is outlined in Section 10 of the National Instruments Act. Payment in due course is defined as payment in good faith and without negligence to any person in possession of the instrument in accordance with the apparent tenor of the instrument (i.e., what appears on the check) under circumstances that do not provide a reasonable ground for believing that he is not allowed to receive payment of the amount therein mentioned.

Section 31 Liability of drawee of cheque.: Section 31 of the Act describes the liability of the drawee of a cheque. This is a common rule that applies to banks. When a drawee of a cheque has adequate money in his hands that are properly relevant to the payment of the cheque, he must pay the cheque when duly required to do so, and if he fails to do so, he must reimburse the drawer for any loss or harm caused by his failure to do so.

Section 85 cheque payable to order: Section 85 is concerned with When a cheque payable to order purports to be endorsed by or on behalf of the payee, the drawee is discharged when the payment is made in due course.

The drawee is discharged by payment in due course to the bearer of a cheque that is originally expressed to be payable to the bearer, notwithstanding any endorsement, whether in full or in a blank, appearing thereon, and notwithstanding any such endorsement purporting to restrict or exclude further negotiation.

Section 85-A Cheque payable to order: Where any draught, that is, an order to pay money, drawn by one office of a bank upon another office of the same bank for an amount of money payable to order or demand, purports to be endorsed by or on behalf of the payee, the bank is discharged by payment in due course, according to Section 85-A.

Section 99-Noting: If a promissory note or bill of exchange is dishonored due to non-acceptance or non-payment, the holder may have the dishonor written by a Notary Public on the instrument, or on a paper attached to it, or on both.

Section 131: Section 131 deals with a banker’s non-liability after receiving a check payment: (Statutory protection to collecting banker) In the event that the title to the cheque proves to be defective, a banker who has received payment for a customer of a cheque crossed generally or expressly to himself in good faith and without negligence shall not be liable to the genuine owner of the cheque just because he received such payment. Section 131A, on the other hand, is concerned with the draft.

The note must be written within a reasonable period after the instrument has been dishonored and must include the date of dishonor, the reason for the dishonor if any, or, if the instrument has not been formally dishonored, the reason why the holder treats it as dishonored, and the notary’s charges.

The next parts, which cover crucial characteristics of a cheque such as crossing a cheque, who can cross a cheque, and non-negotiable cheques, are as follows:

The inclusion of the words and company, or any abbreviation thereof, between two parallel lines, either with or without the words, “Not Negotiable,” shall be constituted a crossing, and the cheque shall be deemed to be crossed generally.

Section 124, Special Crossing of Cheque: Where a cheque bears on its face an addition of the name of a banker, either with or without the words “not negotiable,” that addition shall be deemed a crossing, and the cheque shall be deemed to be crossed expressly, and to be crossed to the banker, according to Section 124.

Section 125: Section 125 discusses the authority to cross a check. After issue crossing when a check is uncrossed, the holder has the option of crossing it, either generally or specifically. In general, when a check is crossed. It is possible for the holder to cross it uniquely. The holder may add the phrase “not negotiable” to a document when it is crossed in general or specifically. When a cheque is crossed for the first time, the banker to whom it is crossed may cross it again for collection to another banker, his agent.

Section 130 Cheque Bearing: The phrase “Not negotiable as” appears on a cheque in Section 130. A person obtaining a cheque crossed generally or specifically with the words “not negotiable” in either case must not have and shall not be capable of giving the cheque a better title than the person from whom he acquired it.

Sections 138 to 142 Dishonor of Cheques: Sections 138 to 142 deal with cheque dishonor, which is defined as when a cheque is drawn by a person on an account maintained by him with a banker for payment of any amount of money to another person from that account for the discharge, in whole or in part, of any debt or other liability is returned by the bank unpaid, either because the amount of money standing to the credit is insufficient. Such a person shall be regarded to have committed an offense and shall be punished by imprisonment for up to one year and/or a fine equal to the double amount of the check, subject to the following conditions:

Cheques must be handed to the bank within three months of the date of the cheque or during the validity period of the cheque, whichever comes first.

Within 15 days of receiving information from the bank regarding the return of the cheque as unpaid, the payee should demand payment of the aforementioned amount by sending a written notification to the cheque drawer.

If the drawer of such a cheque fails to make payment of the said amount of money to the payee within 15 days of receiving the said notice, the payee must file a complaint under this section within one month of the date of the cause of action, i.e. 15 days from the receipt of notice by the drawer of the cheque.

Negotiable Instruments Act, 1881 PDF Download

| Name: | Negotiable Instruments Act, 1881 GK |

|---|---|

| File Type | |

| File Size | 700KB |

| Enforcement Date: | 01-03-1882 |

| Act Number: | 26 |

| Act ID: | 188126 |