Relationship between Banker and Customer – Banking gk + Notes: The customer-banker relationship is really important. The relationship begins at the instant an account is opened by a customer and ends at the time the account is closed. As soon as the agreement or contract is signed, the relationship is established between a banker and a customer. The nature of the relationship is determined by the customer’s account status. Let us first define the terms “banker” and “customer” before moving on to the relationship that exists between a banker and his customer.

What is the definition of a Banker?

The term “banker” refers to a person or company who receives money and collects drafts for customers and is obligated to honour cheques drawn on them from time to time up to the amount available on a customer’s current accounts.

“No person or body corporate or otherwise can be a banker who does not accept deposit account, accept current accounts, issued and pay cheques and collect cheques crossed or uncrossed for his customers”.

– Sir John Paget

“A banker is one who in the ordinary course of his business, honours cheques drawn upon him by persons from and for whom he receives money on current accounts…”

– Dr. Herbert L. Heart

What is the definition of a customer?

In India, the Banking Regulation Act of 1949 provides no statutory definition of the term “customer.” However, a customer may be defined as follows:

A bank customer is someone who uses an account to perform transactions with the bank. An individual, a group of individuals, a firm, a partnership, a corporation, or any other legally valid entity capable of entering into a contractual relationship could be considered a customer. The length of a relationship is no longer a factor.

“… to constitute a customer, there must be some recognizable course or habit of dealing in the nature of regular banking business….”.

– Sir John Page

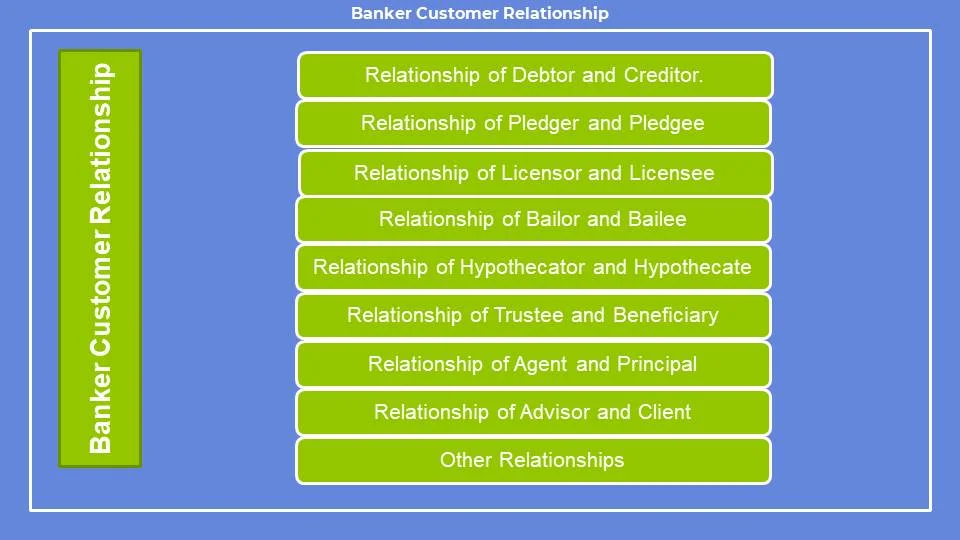

An Overview on Banker Customer Relationship

Primary General Relationship: It is a contractual relationship between Banker and the Customer.

- In a customer’s money, the banker is only a debtor.

- The customer is just the banker’s general creditor.

- Request for deposit repayment is mandated.

Secondary General Relationship:

- Bailee and Bailor: Taking reasonable care of the customer’s safe custody. A banker will be liable to compensate the customer for not taking reasonable care in the preservation of the safe-custody deposits. Whenever the depositor requests it, the banker must pass over the safe-custody deposit to him.

- Trustee and Beneficiary: A banker is a customer’s trustee when a customer deposits money with a bank.

- Agent and Principal: Bankers become the agent and the customer becomes the principal of the bank due to undertake agency service for a customer.

- Mortgagee and Mortgagor relationship: When a customer pledges any valuable assets as security for a loan, the relationship between the banker and the customer is known as mortgagee (pledgee) and mortgagor (pledged).

- Guarantor and Guarantee relationship: In this case, the bank provides a guarantee to its customer by issuing a “letter of credit” to the exporter, stating the stability of the importer’s financial situation.

Special relationship: It is referred to special obligations.

- Banker’s obligation to honour cheques of his customer:

- Banker’s obligation to keep the customer’s account secret:

Rights of Bankers’:

- Right of General Lien: Lien is the right of one person to withhold property belonging to another in his possession until the debt owed to the owner of the property is paid.

- Right of set-off or right of the banker to consolidate accounts.

- The right of a banker to charge compound interest.

- The right of the banker to collect incidental charges.

- When a garnishee order is placed on a customer’s account, the banker’s obligations and rights are outlined.

- Right to charge, interest, commission and brokerage.

- Right to close the account of undesirable customer.

- The Right of Appropriation of Bankers (Clayton’s case).

Privileges of Bankers’

Bankers have specific privileges while dealing with clients in the form of rights such as Right of lien and right of set-off. A lien is a creditor’s right to keep a debtor’s assets until the debtor pays all of his or her debts.

Right of Lien:

A Banker has two types of Liens:

- General Lien

- Particular Lien.

(a) General Lien: A general lien gives the right to keep goods not only for debts incurred in connection with a specific transaction but also for any general balance emerging from the two parties’ general dealings. Only certain individuals, such as bankers, factors, policy brokers, wharfingers, and High Court attorneys, can exercise this privilege. The primary goal of a general lien is to provide protection for bank cash.

(b) Particular Lien: A particular lien gives you the right to keep the goods if you owe a specific amount in connection with a specific transaction. Persons who have spent their effort on such properties and have not yet collected their labour or service expenses from the debtors are subject to this lien. A tailor, for example, has the right to keep the garments he makes for his customer until the consumer pays his tailoring fees. The same is true for public transportation and repair shops.

Bankers have a general lien under Section 171 of the BR Act, which indicates that a bank has a general lien on all goods and securities entrusted to him in his function as a banker. If the commodities are handed to the Banker as a Trustee or Agent, or if there is an agreement to the contrary, the general lien will not apply. Bankers’ liens do not apply to client account balances because they are not considered goods or securities. Bankers are given the right of set-off in this scenario.

# The banker is unable to exercise his lien power on the following items:

- The content of the customer’s safe deposit locker.

- Securities and funds held in trust for a specific purpose.

- In the case of trust accounts in which his customer (on whom the banker wishes to place a lien) is acting as trustee.

- Amounts that are not owed.

- When one of the joint account holders is a customer on whom the banker wishes to exercise his lien.

- Documents and other materials were presented in order to obtain a Joan.

- A general lien cannot be created on a customer’s property that has been pledged as security for a specific debt.

- There is no lien on premises where the client does not have a tide.

- When credit and responsibility are not in the same rights, the banker cannot execute a lien.

- The Limitation Act has no impact on the banker’s lien.

Right of set-off:

Before settling a debt with a creditor, a debtor might recover any debt owed to the creditor. This is known as the “Right of Set-Off.” A banker uses the right of set-off to combine accounts in the same name of a customer and equalize the debit balance with the credit amount in another account, subject to specific restrictions such as the accounts being in the same name, and so on. The right of set-off can only be used against obligations that have become due.

The customer’s bank has the right to terminate the connection with a banker at any time. It can also be caused by legal compulsions such as death, insolvency, Juda/regulatory directives, or the customer’s incapacitation.

Relationship of Banker and Customer

“The relation of banker and customer is primarily that of debtor and creditor, the respective positions being determined by the existing state of the account”

– Sir John Paget

When a person creates an account, takes out a loan, or uses any other bank service, several contractual relationships are formed. Under varied relationships, each of the contracting parties has legal obligations to fulfill. The following are some examples.

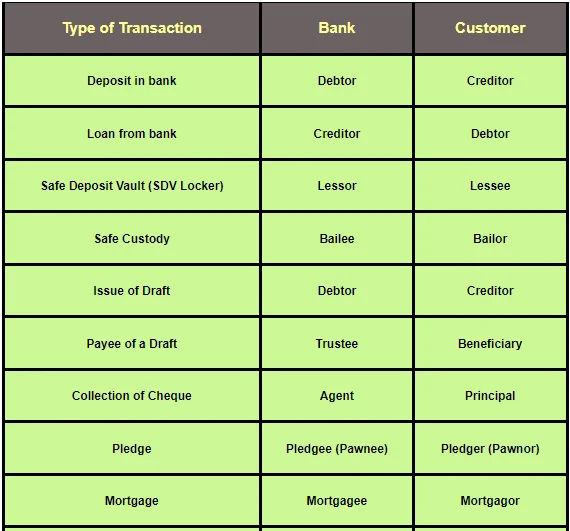

1. Relation of Debtor-Creditor: When a customer creates a bank account, the Bank and the Customer form a debtor-creditor relationship. The bank is the Debtor, the consumer is the creditor. When a bank is legally compelled to pay, it has an obligation to repay the deposit according to the terms agreed upon, including any early repayment requested by the Customer, or to make available any other methods of withdrawing money. Otherwise, due to the intervention of Courts/Government officials such as the Income Tax Department, the Bank is legally prevented from making payment.

2. Relation of Creditor-Debtor: When a customer borrows money from a bank under certain terms, he becomes a Debtor, while the bank becomes a Creditor. The customer, as a Debtor, is responsible for repaying the borrowed funds, plus interest, on the agreed-upon due dates with the Creditor to the Bank. If a customer fails to repay the loan, the Bank, as a creditor, may take legal action to recover the funds from the customer.

| NORMAL DEBTOR-CREDITOR RELATIONSHIP | BANKER-CUSTOMER RELATIONSHIP |

|---|---|

| Even when there is no demand from the creditor, the debtor repays the debt. | The Banker only makes payment when the customer wants it through the submission of a cheque. |

| The creditor usually sets the interest rate. | The debtor, or banker, sets the interest rate. |

| The creditor has the right to demand repayment of the loan at any time. | As a creditor, the customer can only make a demand within the bank’s business hours. |

| The creditor has the option of making an oral (or written) demand. | Customers must make a proper demand by presenting checks, withdrawal slips, or any other method as prescribed by the bank. |

| According to the statute of limitations, the debtor must repay the loan within three years after the date of the loan. | The statute of limitations begins to run when the consumer makes a demand on his deposit. |

3. Relation of Agent-Principal: Remittances, collection, and other situations bring the relationship into focus. When a bank acts on a customer’s instructions, he is said to be acting as an Agent of the customer, who is known as the Principal. This relationship can cease due to death, insolvency, or the customer’s aberrant mental state, or simply at the end of the transaction.

4. Lessor-Lessee: In some transactions, such as when a customer rents a locker, the relationship between the Bank and the customer is that of a lessor and lessee. In this case, the Bank (Lessor) leases a locker space to the Customer (lessee), who agrees with the terms and conditions and hires the locker. e.g. Locker hire and specific lease finance transactions.

In the case of certain lease finance transactions, depending on the form of lease, the lessee lessor is obligated to maintain the assets during the lease time.

5. Trustee Beneficiary: This particular relationship exists as a result of a customer’s explicit request. If a Bank is designated as a Trustee of a deceased person’s estate, for example, the Bank takes on the position of Trustee, and the person who will benefit from the transaction becomes the Beneficiary. In transactions such as escrow agency, the bank’s function as a Trustee is sometimes implied. The Bank, as Trustee, must abide by the terms of the Deed of Trust.

6. Guarantor – Principal Debtor: When a Bank makes a guarantee in favor of a beneficiary at the request of a customer, it plays the role of guarantor. In this form of transaction, the consumer is referred to as the principal debtor. The principal debtor and the guarantor have already agreed on the conditions under which the guarantor will honor the guarantee. The guarantor’s liability expires at the end of the pre-agreed term.

7. Bailee and Bailor: A banker becomes a bailee and the customer becomes a bailor when a bank receives valuables and papers from a customer for safekeeping.

The banker owes the consumer certain obligations and liabilities as a bailee. It’s as follows:

- He must take reasonable precautions to protect the customer’s safe-custody deposits while in his possession.

- If he fails to exercise reasonable care in the safe-custody deposit preservation and the customer suffers a loss as a result, the banker is obligated to reimburse the customer.

- Whenever the depositor requests them returned, he must send over the safe-custody deposit to him.

8. Other responsibilities of a banker in different relationships.

Subject to exceptions such as national interest, the necessity of law, implied or spoken consent of the client, and established banking norms, a banker must preserve absolute confidentiality and secrecy concerning various transactions of his customers. Any improper or unreasonable disclosure will harm the customers’ reputation and may result in not only the loss of the customer but also the payment of penalties that may be imposed by the courts.

Download This Banking Notes PDF

| Name | Relationship – Banker and Customer Notes PDF |

|---|---|

| Subject | Banking and Finance |

| File Type | |

| File Size | 1.2 MB |

| Price | Free (Rs. 29 soon) |

| Exams | SBI, SBI PO, SBI Clerk, IBPS, Clerical Jobs, |