Different Types of Account Holders and Customer in Bank: Banks come into contact with a variety of customers when operating. When a consumer opens an account, a contractual relationship, also known as Banker Customer Relationship, is formed, founded on free will and agreement.

Because each account’s constitution is unique, the requirements vary as well. When working for a bank, different types of accounts have varied legal ramifications.

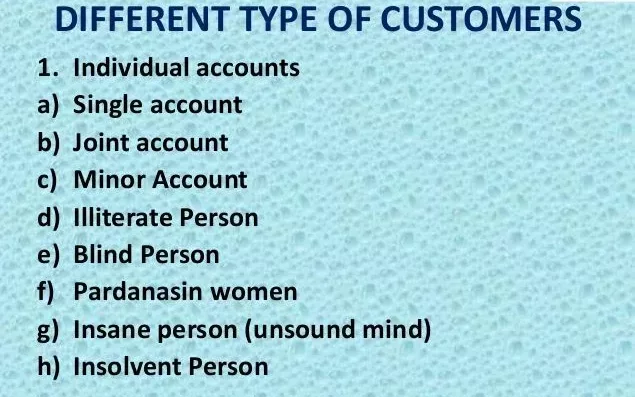

Real and Artificial (or Juridical) people are examples of different types of customers. Individuals in single and joint capacities are considered real persons: Individuals are divided into three categories: residents, non-residents, and foreign nationals.

Proprietorships, Partnerships, Private and Public Limited Companies, Trusts, Clubs, Associations, Executors, Administrators, Liquidators, Co-operative Societies, and other artificial persons are few examples.

Concerns to be aware of when opening an account –

- Anyone who wants to open a bank account must be legally capable of entering into a contract.

- As per KYC requirements, one should be able to provide proof of identity and address.

- Obtaining a new client introduction is critical because it gives legal protection to a bank under Section 131 of the Negotiable Instruments Act.

- The introduction must be written, not spoken. According to RBI standards, well-known officials at a location can also provide an introduction.

- Introduction serves as a safeguard against banker frauds such as the deposit of counterfeit cheques, dividend warrants, Pay orders, Demand drafts, and stolen cheques, and other things.

- In case, a problem arises in an account, the introducer is a valuable resource for resolving the issue.

Aadhaar card, which is a unique identity of a person, has been the main plank of KYC since its implementation. It is the primary document for KYC in “no-frills” accounts. In addition, a copy of the customer’s PAN card and mobile phone number should be collected.

Accounts of an individual

- The account is managed only by the account holder. Documents required for KYC, including a photograph and proof of address, must be obtained.

- The account opening form, which includes an introduction, must be completed.

- In these accounts, nomination is permitted, and the consumer may nominate another person.

- After the death of the deposit holder or a/c holders, the nominee (person thus nominated) can collect the funds in the deposit account without having or go through the much legal hassles.

- At any given moment, only one person can be a nominee.

- Nominations for nominees cannot be made by organisations or other legal entities.

- Depositors are now required to make suitable nominations in every savings account, Term Deposit account, and personal account.

Account of a Minor:

A minor is someone who has not reached the age of eighteen. When a minor reaches the age of 18, he is referred to as a major. When a minor in the custody of the court reaches the age of 21, he becomes a major.

- A deal with a minor is void under the Indian Contract Act. However, a minor’s account can be opened in his or her name and maintained by his or her guardian.

- A natural guardian, a legal guardian, or a testamentary guardian are all examples of guardians.

- The Natural Guardians are the parents. In the absence of parents, the Court appoints a Legal Guardian. A Testamentary guardian is a guardian appointed by a will.

- When a guardian manages an account, his fiduciary status should be clearly stated in cheques and other instruments.

- When a minor becomes a major, the guardian’s authority to manage the account expires.

- When a minor becomes a major, a separate account should be opened, and the balance in the minor’s existing account should be moved to that account after the necessary formalities are completed.

Joint Accounts:

A joint account is created when two or more people open an account together.

- A joint account should be formed among close relatives from a practical standpoint. Everyone should sign the account opening form together.

- A clear direction from the account holders on who will operate the account, such as “jointly by all or anyone or survivor,” should be received. The mandate will be (i) either or survivor or (ii) former or survivor if there are only two joint account holders.

- All individuals’ photographs and confirmation of address are collected.

- In the case of a joint account, all joint account holders should nominate a nominee together. This is to ensure that if all joint account holders die at the same time, the account balance will be payable to the nominee.

Sole Proprietorship Accounts

- Individually conducting business in the name of a company. As a result, it is referred to as “Sole Proprietorship.”

- A proprietary name cannot be used to open a savings account. In proprietary names, only current accounts can be opened.

- Compliance with KYC regulations as well as introduction will be required when creating the account. For KYC reasons, proof of existence such as tax records and a municipal licence under the Shops and Establishment Act should be obtained.

Partnership Accounts

A partnership is a group of people who have agreed to split the earnings from a business that is run by all of them or by one of them acting on behalf of all of them.

- A document called the “Deed of Partnership” spells out the relationships/agreement.

- A partnership should have a minimum of two participants. There is a limit of 20 partners permitted.

- There are two types of partnerships: registered and unregistered.

- Although a minor cannot join a partnership, he or she is entitled to the benefits of one, as well as consent from the other partners. In partnerships, a guardian represents a minor.

- When a minor becomes a major, he or she has the option to leave the relationship. If he does not, he will be deemed a partner from the date of his admission to the partnership, and he will be responsible for all liabilities and losses.

- Because each partner can bind a partnership singularly or jointly by his action, signatures from all partners in their individual capacities as well as in their role as a partner should be obtained when opening a partnership account.

- At the time of account opening, acquire clear instructions from the partners as to who will administer the account.

- Because of the death, retirement, or insolvency of one of the partners, the partnership ends (dissolution).

- If a partnership is dissolved, the account’s operations must be halted if the account is in a negative balance. If this is not done. Clayton’s rule will apply, which will make it difficult for a bank to recover a debit amount.

- Any partner can halt operations if there is a disagreement among the partners. The bank must send a letter to all other partners informing them of the account’s suspension of operations. Any future transactions will be permitted only once all partners have signed a document authorising the bank to do so.

- Photographs of all partners, address proofs for all partners, and a copy of the partnership document should all be obtained when opening the account.

- In industrialized countries, the notion of a Limited Liability Partnership (LLP) exists. In India, this is gaining traction.

Accounts of Companies

A corporation is a legally established (artificial) person that exists solely for legal purposes. The Companies Act of 1956, as revised in 2013, governs the formation of corporations. It is now known as the Companies Act of 2013.

- Companies are permitted to open bank accounts.

- Private Limited and Public Limited firms are the two types of companies.

- Private limited businesses cannot issue public shares, and the minimum number of shareholders should be two, with a maximum number of shareholders of 50.

- A public limited company has the ability to issue shares to the general public. The minimum number of stockholders is seven, while the maximum number of shareholders is unlimited.

- The following documents are necessary to open a company account: Memorandum of Association and Articles of Association.

- A Memorandum of Association often includes information such as the company’s name, registered office address, objectives, statement of liability, and capital details (division of the share capital).

- The Articles of Association normally contain day-to-day guidelines as well as other internal topics necessary for a company’s operation).

- The Registrar of Companies in the jurisdiction where the company is registered issues the certificate of formation.

- A public firm must first obtain a Certificate of Commencement of Business before it may begin business operations.

- To open an account with the bank, a copy of the Board resolution approved by the chairman is required.

- Operating instructions, such as the names of directors and other executives who are authorised to sign documents, should also be gathered.

- The most recent audited balance sheet and profit and loss account, as well as a list of current directors officially attested by the Chairman and the registered office address, should all be obtained.

- Authorized signatories should sign account opening forms. Photographs of authorised signatories should be collected in accordance with KYC guidelines.

- The company’s seal should appear on all significant documents (Embossing Stamp).

Accounts of Trusts

A trust is a legal entity established by a person (referred to as the “Creator” or “Author”) for the benefit of another person or group of people (referred to as the “Beneficiary”) or for a cause and maintained by a person or group of people (referred to as the “Trustee” / s “).

- A trust is established for specific or several causes. Trusts can be established for private or public purposes. A trust can be either a registered or unregistered organization.

- Trustees are often in charge of trust property, which is managed according to the trust deed’s terms and conditions. The original trust deed should be requested when opening such accounts.

- This deed should be reviewed in order to understand the trustee’s rights and responsibilities. A trust also establishes rules and bylaws to ensure the trust’s proper operation. This document should also be examined in order to ensure correct bank account operations.

- Specific instructions from the trustees should be acquired as to who among the trustees will be in charge of the account. All trustees should sign the account opening form.

- Accounts held by trusts are subject to the same KYC requirements. A trustee cannot appoint anyone else unless the trust document expressly allows it.

- If the board of trustees changes, formal paperwork signed by all of the trustees should be obtained. Any of the trustees has the authority to halt the account’s operations.

- Unless the trust deed allows it, operations in the account should be halted in the event of a trustee’s death.

- Unless the trust deed enables the trust to continue, operations in the account should be halted if a trustee becomes mentally ill.

- The trust is unaffected by a trustee’s insolvency.

Accounts of Clubs and Associations –

- Individuals who come together for a shared could establish these types of organizations.

- There are two types of clubs/associations: registered and unregistered. Banks generally insist on opening accounts for registered bodies due to legal constraints.

- When opening accounts, the usual KYC processes, as well as relevant legal formalities, must be followed.

Accounts of Co-operative Societies.

- Individuals form cooperative societies, which are governed by cooperative legislation and must be registered with the Registrar of Co-operative Societies.

- Co-operative Societies get their money from their members and can do whatever they choose with it.

- A copy of their registration certificate, the most recent financial statements, a list of office-bearers, a copy of the general body’s or managing committee’s resolution appointing persons authorised to operate bank accounts, specimen signatures, and photographs of persons authorised to operate the account are all obtained when opening an account.

- Whenever the office bearers/managing committee changes, a certified true copy of the managing committee’s resolution embodying the change must be obtained and filed with the existing account opening forms.

Accounts of Special Types –

Insane persons and Drunkards –

An insane individual is mentally ill and so unable to contract. In most cases, such people’s accounts are not opened. When a banker learns that the account holder has gone insane after creating an account, operations in the account should be halted until a court order is issued or the banker has convincing proof of the account holder’s sanity. Drunkards are unsound in mind and unable to contract in their drünkin state. Contracts made when inebriated are null and void. As a result, if a banker establishes a drunkard’s account on purpose, he risks losing his job.

Illiterate persons –

If they are competent to contract, they enter into a contractual partnership. As a result, a banker must exercise caution while opening accounts for illiterates. Because illiterate people cannot read or write, their thumb impressions are taken instead of signatures. Males’ left-hand thumb (LHT) impressions are taken, while females’ right-hand thumb (RHT) impressions are taken. These thumb impressions have been verified by known witnesses.

A Photograph, address evidence, and other types of identity are obtained.

Blind person

- If a blind individual is psychologically capable of contracting, a banker will open an account for him or her.

- They should be verbally briefed on all requirements connected to opening accounts in the presence of a witness and, as a result, acquire the witness’ signature.

A woman who is married:

A married woman has the authority to enter into a legal contract. As a result, the banker establishes a joint account in the name of a married woman. In the case of a debt incurred by a married woman, her husband is not accountable unless the following conditions are met:

- If she takes out a loan to meet her basic needs,

- If she takes out a loan for home necessities,

- If she acts as her husband’s agent.

Pardanasheen Women:

In accordance with her own community’s norm, a paid ana sheen woman maintains strict solitude. She does not interact with anyone outside of her own family. As the presumption in law, she is fully isolated. When opening an account in the name of a park ana sheen woman, the banker should use caution. Because such a woman’s identification cannot be established, the banker will usually refuse to open an account in her name.

Joint Hindu family:

It’s an undivided family made up of all male members who have a common ancestor. A Joint Hindu Family is one that has more than one person, owns the ancestral property, and runs a family business. The senior male member is referred to as “Karta,” while the other male members are referred to as “coparceners.” Karta is in charge of the entire family’s company and has unlimited liability, whilst coparceners have limited liability. Managers can be appointed by coparceners. For the purpose of raising the loan, Karta has the power to mortgage and pledge JHF’s property.

Executors and Administrators –

A court appoints these individuals. An Executor is a person who is named in a person’s Will (also known as a “Testator“). When the owner of the property dies without leaving a Will or the specified individual refuses to take up the duty, a court appoints an Administrator to handle the estate or property.

A banker should get certified copies of legal documents issued by a court in the subject, such as “Probate” or “Letters of Administration,” and retain them on file before opening such accounts. These documents will govern the activity of these accounts.

Executors and administrators are not allowed to assign their authority to others. If an Executor or Administrator becomes insane, his or her authority is revoked. A banker should seek directions from the Court that has appointed him in this situation.

The bank account will not be affected by the bankruptcy of an Executor/Administrator.

Liquidators: During the winding up of a corporation, a court appoints liquidators to sell the assets and properties of institutions, as well as collect money from debtors and settle creditors’ claims. The conditions of the court order appointing the Liquidator should be examined and understood before opening an account with the Liquidator.

If a company is voluntarily liquidating and a Liquidator has been appointed, the provisions of the company’s resolution to open the account should be examined. At the meeting, the Chairman must certify such a resolution (winding up).

The Banker obtains an account opening form signed by the Liquidator and additional documents to authenticate his personal information.

According to the rules of the resolution, operations will be permitted in such accounts.

Summary: Types of Customers A/C Holders in Banks

- Individuals Account: Account can be opened individually for personal uses.

- Minor Account: Account for under 18 years old.

- Joint Account: Account for two or more persons.

- Married Woman: Account for a married wonam.

- Pardanasheen Women: identity of such a woman cannot be ascertained,generally refusued to open account by bankers.

- Illiterate Person: Account for those who can not read and write. only thumb impression is used insted of sign.

- Sole Proprietorship Accounts: Business carried out in farm’s name solely by an individual. Hense it is known as “Sole Proprietorship”.

- Partnership Accounts: Account for having relation between persons who have agreed to share the profits of a business.

- Accounts of Companies: Accounts for Public Limited companies and Private limited compatnies.

- Accounts of Trusts: These accounts are created by the settler through executing a Trust Deed

- Accounts of Clubs and Associations: Accounts for Societies, Clubs and Associations.

- Accounts of Co-operative Societies.

- Joint Hindu family: Account for Joint hindu family consists of large number of family memebers.

| GK Notes | Types of Account Holders and Customer in Bank Notes PDF |

|---|---|

| Subject | Banking and Finance |

| File Type | |

| File Size | 800 KB |

| Price | Rs. 29 |

| Exams | SBI, SBI PO, SBI Clerk, IBPS, Clerical Jobs, Bank Exam, Finance Related Exams. |

| Buy | Click the buy link below |